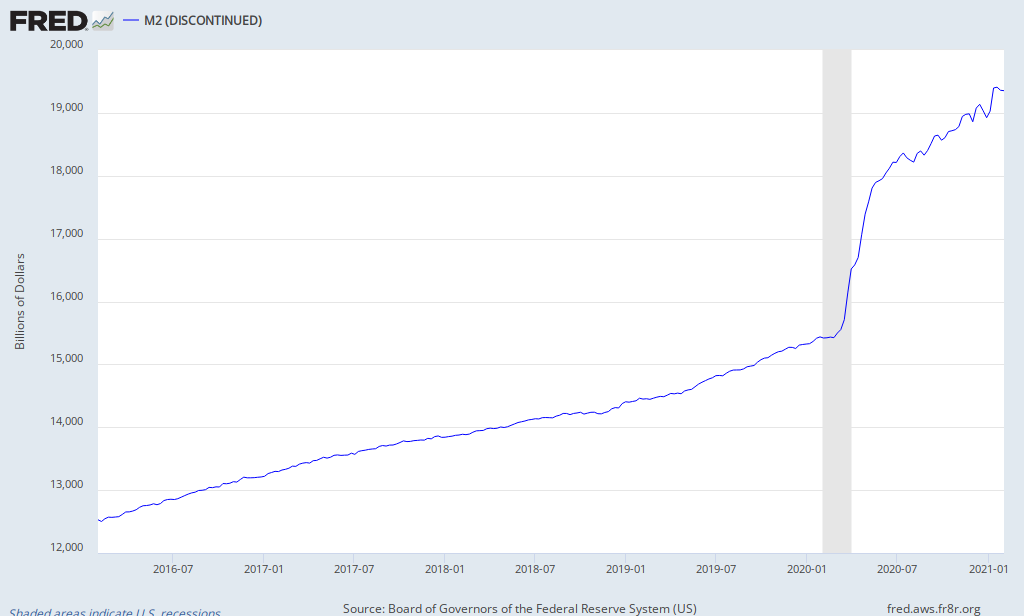

The general idea about inflation we are taught is that the greater the supply of money, the less a single dollar is worth, and the prices for the goods we buy should rise. This simple model usually holds true, yet policies by the Federal Reserve over the past five years have substantially increased the supply of money but have failed to stimulate above average inflation. Inflation lowers everyone’s purchasing power and erodes the real return on investments, so keeping an eye on when inflation might rise is important.

Author Archives: Neil Gilliss, MBA, CFP

Standard Distinction

One of the things we harp on at our firm is abiding by a fiduciary standard. This standard compels us to always act in the best interest of our clients. In our business, that means recommending investments that we believe will best achieve a client’s goals regardless of how transacting in those investments effects our bottom line. As professional purveyors of advice we believe it would be disingenuous, if not downright wrong, to provide anything but objective guidance. We also believe it sets us apart from large wire house brokers and advisors who are not held to that same standard. Read more

Welcome to Rebalanced

Rebalanced is a blog about investing and life. If one understands the former, it has the potential to enhance the quality of the latter. Wall Street is crowded with conflicts, uncertainties and mistrust. The objective of this blog is to educate investors in a manner that is understandable. Read more